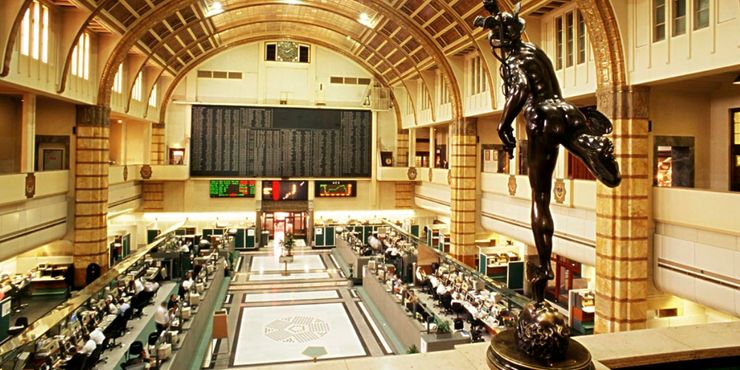

The role of exchanges in securities supervision

When providing organized space for traders, the exchange brings market participants together to conduct transactions, gather information, and supervise each other in accordance with agreed rules. This section explains the role of exchanges in capital allocation and market supervision. On the one hand, the rules rely on exchanges to supervise the market to enforce securities laws and industry regulations. On the other hand, regulatory policies strengthen competition in trading services. Disparate priorities have led to a severe decentralization of the trading venue network, leading to the emergence and growth of "dark pools" (ATS).

(1) The demand for public rules in the capital market

The securities market transfers capital from investors to companies that can use wealth to promote growth, and high costs will hinder this goal. Investors who wish to buy or sell securities on the secondary market face many organizational obstacles. First, they must find each other, and the search process is scattered and unclear. In addition to finding counterparties, traders must also prepare for negotiation fees, which require legal input and bargaining. Finally, when there are fraudsters, cheaters, and manipulators in the market, distrust of transactions is very common. In an environment where self-supervision is the main method, high costs will create barriers to entry for market participants. Powerful traders are protected by the stock exchange, and only these traders can bear the greater risks brought by their peers. This will seriously affect the capital market and its ability to allocate capital.

(2) Exchange and capital allocation

The exchange institutionalizes the work of securities traders and reduces the inherent information, compliance, and transaction costs of transactions. First, the exchange sets basic rules for companies wishing to go public to ensure that they meet the standards of financial soundness, governance, and organizational viability. Second, the exchange brings investors together and trades securities in accordance with established rules. Therefore, the exchange seeks and establishes a network of traders and information to effectively allocate capital. By bringing qualified traders to the market, the exchange can play its best role. The more traders the exchange attracts, the easier it is for these participants to conclude transactions and exchange information, and more business means more profit. Stable profit margins enable exchanges to reduce fees and use lower fees to attract more traders to the market, further driving this growth cycle.

Exchanges that introduce a large number of actors into the price formation process can help improve information efficiency and capital allocation. The ability of exchanges to effectively create prices has become a sign of their functions. For a long time, the exchange has been investing in the construction of the required systems, spreading prices extensively and in a timely manner through various innovations. Through the circulation of price information on the exchange, the exchange can "build" a viable market for financial products, linking the formation of prices with the allocation of market capital.

(3) The significance of exchange supervision

In view of the role of exchanges in gathering traders, approaching and generating information, it is an ideal choice for supervision, monitoring, and restraint of the market. Exchanges are the medium of securities trading, making them the most sensitive to market activities. In addition, network effects make traders cherish the opportunity to enter the trading floor. For traders and issuers seeking to enter the market, the threat of rejection, sanctions or condemnation by the exchange makes them abide by the law.

Regulators rely on exchanges to set standards for trading behavior and assist in the enforcement of securities laws. Article 6 of the Securities Exchange Law requires the exchange to ensure that its users comply with the exchange’s own rules and applicable laws and standards. Theoretically, the exchange has a strong incentive mechanism and can carry out high-quality supervision. In return, the exchange enjoys extensive legal immunity when performing its supervisory function, and is not affected by investor litigation.

The main areas where the exchange has regulatory powers over traders and issuers are:

1. Company listing rules

The exchange has established a series of rules and conditions for companies that wish to publicly issue securities and go public. The listing criteria cover the full range of company organization, business, financial integrity, as well as ongoing activities and events. The "New York Stock Exchange Listing Manual" lists the NYSE's listing qualifications, requiring any listed company to meet specific corporate governance and financial conditions, and to disclose extensive information in terms of earnings, market value, board composition, and key personnel. Listed companies must keep abreast of major events and correct misinformation in the market, which helps the exchange to complete market monitoring. For investors hoping to return, this review has huge benefits. In addition, the supervision implemented by the exchange to implement securities and corporate governance standards help to regulate the internal composition and behavior of listed companies.

The importance of review is obvious when the exchange implements its rules. If the company fails to meet the corporate governance standards, it is not in the public interest to trade certain securities, or the exchange considers the company unsuitable for listing, the exchange can make the company subject to self-discipline or delisting. The market's response also shows that investors are paying attention to the value of the signal from exchange enforcement.

2. Rules of conduct for traders

In addition to studying the behavior of listed companies, the exchange also stipulates operating rules for traders. The exchange does not allow any interested persons to enter the market, but instead restricts those who meet certain qualifications from entering the market. In addition, traders must abide by the rules of conduct on the trading floor. The rules of conduct are designed to protect the market from the risk of traders' abuse of fraud, manipulation, or misuse of inside information. According to the Securities Exchange Act, national trading has considerable powers to impose disciplinary sanctions from condemnation to market bans on members who fail to comply with applicable laws and exchange rules.

The exchange has close information and trading ties with traders, and has extensive experience and expertise in understanding trader behavior. In addition, the exchange can be informed of the latest actions on the trading floor as soon as possible. The point is that the penalties imposed by the exchange, including fines, public condemnations, formal warnings, and eventual market bans, will result in reputational impairment and make traders lose the actual economic costs of free trading of securities. In addition, exchange supervision can save investors and taxpayers time, money, and energy, while investors can rely on exchanges for supervision. By monitoring and enforcing securities rules, exchanges can reduce the resource burden on public finances and increase supervision of the market, so that public regulators can also benefit from it.

Competition and differentiation of market structure

The exchange attracts transactions because of the advantages of the network. When all transactions are integrated into one or a small number of places, the market can produce the best service. Integration can increase network externalities, and it can also increase price efficiency by promoting more effective exchange supervision. The disadvantage of integration is that it encourages monopoly or oligopoly, and exchanges are fully capable of collecting private rents from users. If the exchange becomes a for-profit organization and seeks to maximize returns from investors and listed companies, the risks will be particularly prominent.

The US regulatory policy attempts to balance the benefits and risks of integration through a two-pronged approach: (1) Forcing exchanges to compete with each other and with non-exchange trading facilities; (2) Widely requiring any investor to be able to trade at the lowest price. By promoting competition to generate the best price for the system, supervision attempts to establish a nationwide market. Every exchange and the trading venue strives to attract companies to its own market, and therefore must compete. However, they can also be interconnected through strong information and transaction linkages, enabling investors to choose where to trade. Even so, the policy has caused the market structure to evolve from integration to the current state of severe differentiation.

(1) Reasons for competition

The securities will be traded on the exchange where they were first listed. If a listed company is listed on the NYSE, any investor who wants to buy and sell stocks in secondary trading also needs to enter the NYSE. This arrangement provides several benefits to the exchange. First, the exchange can rely on stable trading volume to get fees, disseminate information, and generate network revenue. In addition, it also ensures the active participation of market makers (independent securities operating legal entities that make profits through bid-ask spreads) to maintain liquidity and prevent peaks and collapses of supply and demand. This situation makes securities transactions naturally concentrated in one market.

The problem with integration is that exchanges and dealers can see reliable listing and secondary market trading volumes and collect rent from them. Traders can also maintain unreasonably high spreads. In addition, integration can hinder investor choice. Investors can have different preferences, and only trading on a few exchanges will force different trading groups to homogenize and fail to achieve multiple strategic goals.

Supervision attempts to solve the problem of high investor costs by establishing a national market system. The core goal of its design is to ensure that investors anywhere in the system can get the best price for transactions. They do not have to trade on the exchange where the securities are listed, but instead trade anywhere in the system that provides the best displayed price. The "Order Protection Rules" prohibits the trading center from executing orders at a price worse than the best available price in the system. In order to ensure that securities can be traded in the most cost-effective locations, exchanges need to continuously provide quotes to national stock codes so that the national exchange network can provide the best price information.

(2) The rise of alternative trading venues

Regulatory policies encourage the creation of multiple exchanges and alternative trading venues to solve the problem of investor choice. Without multiple competitive venues, the dominant exchange will lack the incentive to lower prices or create conditions to provide investors with diversified services. The SEC intends to use competition as a policy preference in market design. The Alternative Trading System Regulations (Reg ATS) allows ATS to trade nationwide listed securities without requiring formal authorization under Article 6 of the Securities Exchange Act. According to Reg ATS, broker-dealers can set up venues to match buyers and sellers without being authorized as an exchange.

This means that broker-dealers can establish private platforms to trade securities, or establish their own communication networks to connect investors, and broker-dealers enjoy considerable freedom in establishing non-exchange trading mechanisms, expanding investor choices, and reducing transaction costs. What is important is that ATS operates within a looser regulatory system than traditional exchanges. Unlike exchanges, ATS has broader obligations, that is, to ensure fair access to its premises, continue to disclose prices, and assume the obligation of market supervision. Therefore, ATS has a lighter regulatory burden.

ATS represents a different transformation from traditional exchanges. Before the transaction, ATS does not have to display its pre-transaction quotation. After the transaction, the information that appears in the public domain will be delayed, which is not synchronized with the practice of public exchanges. Because of this, ATS is commonly known as a "dark pool", that is, a place with limited price transparency. In addition, ATS has much lighter supervision and compliance responsibilities, and its ability to set and supervise its site rules is severely restricted. It cannot supervise the core organizational characteristics of its users, such as financial resources, employee qualifications, or books and record keeping. Because the ability to control user institutions and behaviors is weak, ATS can enjoy lower supervision costs.

(3) The structural impact of competition

The Securities Industry Management Regulations and the Order Protection Rules have changed the structure of the securities market. The most obvious is the surge in the number of trading venues, which has affected the volume of business flowing to public exchanges. Since the implementation of the "Order Protection Rules" in 2005, the NYSE’s virtual monopoly in secondary market transactions has continued to decline, from 80% to 34% in just three years, and over-the-counter trading venues account for 30% of all stocks.

The decline in exchange supervision

Due to the pressure of decentralization and competition with low-supervision platforms, exchanges have been severely weakened in providing oversight. In addition, in a market with interconnected businesses, the risks brought by competition make exchanges underinvest in governance.

(1) The high cost of exchange supervision

In order to monitor the market, detect bad behavior, and punish errors, manipulation, fraud, and interruptions, supervisors must invest a lot of resources. The cost includes not only the funds needed to support the oversight of the infrastructure, but also the investment in time, expertise, and reputation.

The Exchange’s “Articles” stipulate that all trading companies shall be responsible for supervising and restraining companies listed and traded on the exchange. First of all, exchanges need to invest in the establishment of monitoring and surveillance systems. Driven by the growth of technology exponential and the intensity of modern high-tech market data, this cost is rising. In addition to supervision, exchanges must also invest in self-discipline penalties. When asked to punish traders and companies that earn income, as a for-profit company that relies on the business of traders and listed companies, the exchange will be more cautious about paying customers.

The exchanges have sought good strategies to deal with this conflict. They established an independent legal entity (different from the exchange itself) to punish violations. In addition, the exchange outsources its regulatory responsibilities to the Financial Industry Regulatory Authority (FINRA) to varying degrees. However, decentralization has further increased the cost of supervision and weakened the enthusiasm of exchanges to invest in supervision. First, the reduction in the share of exchange business caused by decentralization increases the transaction costs of maintaining order and reduces the financial incentives for effective task execution. In addition, in a decentralized market, exchanges cannot internalize the full benefits of regulated investment. Instead, competitors received these benefits. However, in terms of competition, exchanges must bear a high percentage of monitoring costs. In maintaining order, ATS faces light obligations.

The rising cost of supervision of each transaction and the uneven distribution of supervision costs between global services and exchanges have deepened the exchange’s conflict of interest. As a for-profit institution, the exchange faces the dilemma of satisfying its private responsibilities to its shareholders and its public responsibilities to the market. The pressure caused by increased competition and reduced trading revenue has also prompted exchanges to look for other sources of profit. For example, exchanges pay traders who bring liquidity to them. In addition, the exchange also sells data sources and promises to be more detailed and faster than the publicly available information flow. They also sell real estate, facilitating faster transactions between exchanges and traders. The exchange even provides consulting services to users to help them comply with exchange rules and corporate governance guidelines. Therefore, despite the decline in exchange trading volume, the exchange’s revenue is increasing, and revenue from technology and data services is growing.

The closer business relationship between the exchange and its users has led to conflicts of interest for strict enforcement of the rules. Basic conflicts of interest make the exchange cautious about major customers. However, when exchanges can control business volume as part of an integrated market structure, the cost of conflict increases, making the exchanges have to consider disciplinary actions against paying members. In an environment of declining trading volume, law enforcement is more likely to cause exchanges to lose customers. In addition, these customers will transfer their business to other platforms, that is, market fragmentation allows the exchange to profit from the provision of other services, increasing the cost of supervision.

(2) Information gap and coordination failure

A decentralized market means that exchanges face high costs in monitoring activities on trading platforms other than themselves. However, without this information, the exchange cannot fully determine the risks of itself and the market.

The supervision of exchanges faces a problem: traders can flow across systems. However, the exchange can only effectively monitor the activities in its own market, which makes the exchange face a blind spot. Blind spots mean that exchanges face high information and coordination costs in supervision, making it more difficult to detect improper behavior and enforce securities rules.

The exchange has two options to monitor the market. First, they can monitor other exchanges and dark pools to overcome information deficiencies. The exchange can search for trader information from other places, carefully review the prices after the transaction, or observe abnormal transactions that may be connected to information from other places on its own platform. But this option is too resource intensive and not feasible. Exchanges can also work harder to supervise individual traders. However, dark pools and exchanges have different investor groups. Dark pools are more attractive to uninformed traders, and informed traders are more inclined to trade on public exchanges. Different groups make detailed personal supervision almost impossible. Related to this, financial theory believes that market makers will move to places with a large number of unsuspecting investors to make money. Therefore, dark pools should be more attractive to market makers, which makes the exchange's efforts to monitor traders more difficult.

In addition, even if the exchange exercises disciplinary sanctions on traders, for example, if the exchange requires traders to retain more capital, this may not fully reflect the risks of traders. Without fully understanding the behavior of traders in other venues, the exchange may underestimate the risks posed by unsuspecting traders.

(3) Insufficient investment in supervision

The asymmetric supervision responsibility between the exchange and the dark pool makes the compliance cost of the exchange relatively high.

First, the exchange has no incentive to exceed the minimum investment level, and will not exceed the scope sufficient to supervise users on its own premises. Because from the perspective of self-interest, it is unnecessary for the exchange to conduct supervision in other places.

In a decentralized market, when the exchange's own supervision failure may suffer serious losses, the market may transfer part of the cost to another exchange or dark pool. Since the risk is easy to transfer to another place, the exchange has the following options when deciding to supervise investment: (1) invest huge sums of money to ensure that its premises are actively supervised and maintain the safety of itself and other places; (2) invest sufficient funds to ensure the safety of its premises, but allow risky behaviors that externalize costs to another location; or (3) insufficient investment in supervision, because risky behaviors can generate profits.

In the domestic market, exchanges and dark pools are connected through transactions and information, while traders and data can be easily transferred from one location to the next. This means that if the exchange does not internalize the full consequences of its risks, its incentives to monitor its own platform will also be reduced. So it will not internalize the full cost of taking the risk, because the cost is also borne by other places. At the same time, despite the exchange’s efforts to ensure the safety of the exchange, the risks of other venues will also be transferred to the exchange.

If the exchange wants to monitor the risks of its premises, the decentralized and interconnected market design means that it must monitor and supervise the risks generated by traders in other locations. Exchanges must collect information more fully and understand the behavior of traders in other places, but this method will bring benefits to competitors. On the contrary, the insufficient regulatory investment represents a reasonable allocation of the exchange's regulatory resources. Even with minimal supervision of its own premises, exchanges can also bring benefits to competing exchanges. Strong supervision is beneficial to others and harms the profitability of the exchange itself; while weak supervision can reduce its own transaction costs and increase profitability.

In summary, the decentralized market encourages exchanges to take greater risks, and market dispersion weakens the exchange's ability to conduct effective supervision.

Market responsibility design

The role of for-profit exchanges as supervisors has always been controversial, and there is a conflict between pursuing their own profits and assuming the responsibility of protecting the public interest. However, laws and regulations still give it the power to monitor the flow of venture capital in the economy. The decentralization of the market makes it impossible to achieve this task, and it is not feasible to restore the market to an integrated structure. In this case, it is more effective to expand the responsibilities of exchanges and dark pools and hold them directly responsible for regulatory failures, which means that the exemption from exchanges is canceled. In a decentralized market, due to weak supervision, the possibility of errors and interruptions is magnified, and strong responsibilities can help offset the laxity of supervision and law enforcement by venues. Finally, peer supervision between sites should be encouraged to hold each other's supervision responsibilities.

(1) Possibility of resuming the merger

Market dispersion has eroded the structural advantages that exchanges have during supervision, such as network externalities and traders' deep information reserves. The proliferation of dark pools has attracted a large number of traders and their information. Exchanges are forced to fill these gaps on stricter budgets, which makes the exchange’s profit motives take precedence over the public interest, thus exposing investors to higher risks.

(2) Market responsibility design

Trading venues can promote supervision by increasing legal responsibilities and setting up collective responsibilities between exchanges and dark pools. Historically, exchanges have enjoyed extensive liability immunity when performing their supervisory functions in exchange for the public interest in maintaining order. However, systemic errors, misinformation, and fraud on exchanges can affect the value of securities, causing investors and listed companies to bear the costs of ineffective exchange supervision, which undermines capital allocation. Large investors and listed companies are generally inefficient monitors and cannot rely on them to internalize exchange fees. In addition, regulations give broad powers to the exchange’s supervision. However, decentralization poses structural challenges to the supervision work. In cases where mergers are not possible, supervisory requirements must be adapted to the fragmented market.

From the perspective of risk-sharing between exchanges and ATS, it is necessary to make dark pools and exchanges liable for supervisory errors. Although dark pools may continue to benefit from loose supervisory constraints, it makes sense to expand the scope of supervision and authorization to cover dark pools. Dark pools and exchanges custody traders on the national unified securities market. In addition, given the widespread information connection, risks may spread from dark pools to exchanges (and vice versa).

Therefore, the constraints assumed by existing exchanges and dark pools are obviously asymmetric. Just as exchanges must ensure compliance with securities laws and prevent fraud and manipulation, similar requirements should be explicitly extended to dark pools. Regulators have proposed some measures to require dark pools to disclose more information about the details of their operations. It seems that their role in supervision should also be deepened. In addition, dark pools should conduct more stringent reviews of investors, because of the different access standards between dark pools and exchanges, traders with lower qualifications will use dark pools for potentially risky transactions.

If the market responsibility system is lacking, it will lose the credibility of restraint on bad behavior and supervision of exchanges. Therefore, it is recommended to set up a shared fund funded by the exchange to pay for the loss when a single exchange cannot compensate for the loss. The basis for this recommendation is that in interconnected markets, a single location may not always be able to pay claims. When encouraging collective monitoring and supervision, such funds should include donations from dark pools and exchanges. The fund can support the losses caused by inadequate supervision of exchanges and dark pools to: (1) compensate investors for losses due to the failure of exchanges or dark pools to perform their supervisory duties; (2) reduce the bad incentives of exchanges or dark pools to take risks; (3) force exchanges and dark pools to actively supervise each other.